What is it?

Sales and use tax is a form of tax that is imposed by both state and local governments on the sale or use of goods and services. Sales tax is assessed by the state or local government to the seller and is a certain percentage of the sale. This percentage varies by state and locality. The sales tax is usually passed on to the buyer, resulting in the buyer paying the tax.

When the states first enacted their sales taxes, the tax was imposed only on in-state sales. There was no use tax. As businesses began to offer delivery services and customers realized they could avoid sales taxes by ordering products from businesses in a different state, the complimentary use tax was enacted so that states could collect it directly from the buyer. Currently, every state that imposes a general sales tax also imposes a use tax.

How much do I pay in Sales and Use Tax?

If sales tax is applicable on a transaction you make, it is added on by the seller at the time of purchase. Next time you go out to eat at a restaurant, look for the sales tax on the receipt. There might also be an additional food and beverage tax. There are many different types of sales taxes and they vary between each state and locality. For instance, there are 26 different sales taxes listed on North Carolina’s Department of Revenue website.

For use tax, the answer is you probably have never paid it and you still do not pay it. Before 2019, states and local governments were prohibited from collecting sales tax from out-of-state sellers on purchases made by their residents. This mainly occurred through e-commerce transactions such as Amazon purchases. This was thanks to the Supreme Courts decision in Quill Corp. v. North Dakota, decided in 1992, which stated that a business has to be physically present in the state to be subject to sales tax. The prohibition meant that the only recourse state and local governments had was to collect use tax from their residents. Buyers were required to report and pay use tax to their home state on any purchases they made where the seller did not charge and remit sales tax, such as Amazon purchases. However, very few taxpayers did this, and enforcement was too impractical and unappealing to state and local tax authorities. An NPR article from 2013 estimated the merely 1.6% of the population paid their use tax.

In 2018, the Supreme Court overturned the prohibition with their decision in South Dakota vs. Wayfair. The court struck down their physical presence requirement established in Quill, and upheld the legality of the “economic nexus” test used by South Dakota instead. This “economic nexus” test allows states to impose sales tax on the out-of-state seller if they meet certain thresholds that indicate a close enough connection to the state to be considered “doing business” in the state. The decision allows states and local governments to enforce their sales tax laws on out-of-state retailers who sell to individuals or businesses within their borders. The result is more transactions being assessed sales tax and less of your transactions that are subject to use tax.

I have a small online store. Am I responsible for charging and remitting Sales Tax in light of South Dakota vs. Wayfair?

It depends on how small the business is and whether you use an online facilitator or not. All states that charge sales tax only require out-of-state sellers to remit sales tax if they have “nexus” in the state. Nexus is a term that can be defined as a business having a close enough business connection to the state that they are considered to be “doing business” in the state and required to pay sales tax. In the Wayfair case, South Dakota had determined out-of-state businesses had nexus in South Dakota if they either:

- Sold more than $100,000 of goods or services into South Dakota on an annual basis, or

- Engaged in 200 transactions that resulted in goods or services being delivered to South Dakota.

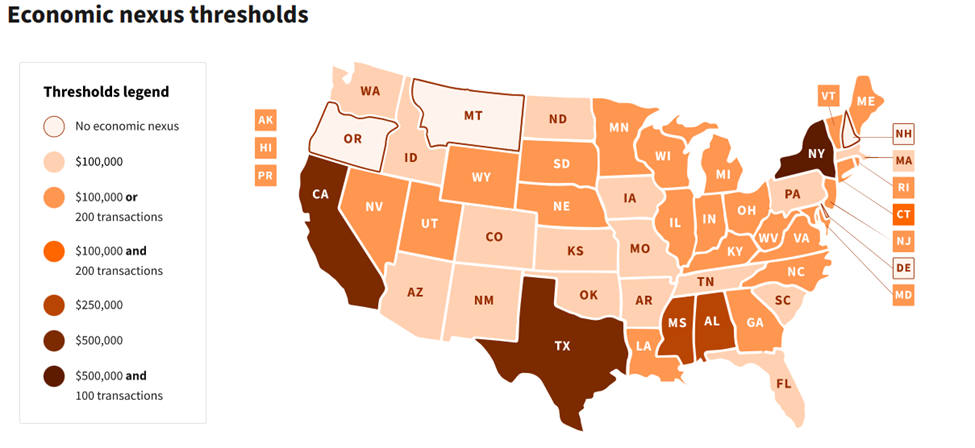

After the Supreme Court upheld South Dakota’s position, most states began enacting their own nexus requirements similar to the ones used by South Dakota. Below is a chart highlighting the general Nexus thresholds for each state as of the publication of this article. It shows two nexus requirements: the first is the dollar figure threshold for sales to buyers within the state, and the second shows the number of transactions threshold for sales within the state. It is important to note that these are just 2 nexus threshold requirements among many. Many states may have additional requirements that, if met, would require paying sales tax regardless of their status for the two categories below. However, these are the 2 categories that are used across all states.

These thresholds are likely to be changed by some states as time goes on. There are numerous websites dedicated to keeping track of these new nexus requirements. One of the more popular websites is Quickbooks. You can find a link to their nexus map at the link below.

https://quickbooks.intuit.com/r/taxes/sdakota-vs-wayfair

| State/Territory | Amount of Sales ($$) Nexus | # of Transactions Nexus |

|---|---|---|

| Alabama | $250,000 + | — |

| Alaska* | $100,000 + | 200 |

| Arizona | $200,000 + | — |

| California | $500,000 + | — |

| Colorado | $100,000 + | — |

| Connecticut | $100,000 + | 200 |

| Delaware | No State or Local Sales Tax | |

| District of Columbia | $100,000 + | 200 |

| Florida | $100,000 + | — |

| Georgia | $100,000 + | 200 |

| Hawaii | $100,000 + | 200 |

| Idaho | $100,000 + | — |

| Illinois | $100,000 + | 200 |

| Indiana | $100,000 + | 200 |

| Iowa | $100,000 + | — |

| Kansas | $100,000 + | — |

| Kentucky | $100,000 + | 200 |

| Louisiana | $100,000 + | 200 |

| Maine | $100,000 + | 200 |

| Maryland | $100,000 + | 200 |

| Massachusetts | $100,000 + | — |

| Michigan | $100,000 + | 200 |

| Minnesota | $100,000 + | 200 |

| Mississippi | $250,000 + | — |

| Missouri | $100,000 + | — |

| Montana | No State or Local Sales Tax | |

| Nebraska | $100,000 + | 200 |

| Nevada | $100,000 + | 200 |

| New Hampshire | No State or Local Sales Tax | |

| New Jersey | $100,000 + | 200 |

| New Mexico | $100,000 + | — |

| New York | $500,000 + | 100 |

| North Carolina | $100,000 + | 200 |

| North Dakota | $100,000 + | — |

| Ohio | $100,000 + | 200 |

| Oklahoma | $100,000 + | — |

| Oregon | No State or Local Sales Tax | |

| Pennsylvania | $100,000 + | — |

| Rhode Island | $100,000 + | 200 |

| South Carolina | $100,000 + | — |

| South Dakota | $100,000 + | 200 |

| Tennessee | $100,000 + | — |

| Texas | $500,000 + | — |

| Utah | $100,000 + | 200 |

| Vermont | $100,000 + | 200 |

| Virginia | $100,000 + | 200 |

| Washington | $100,000 + | — |

| West Virginia | $100,000 + | 200 |

| Wisconsin | $100,000 + | — |

| Wyoming | $100,000 + | 200 |

* The state of Alaska does not have a sales tax, but local governments do and base the sales tax off of total sales within the state of Alaska.

The specific details on how to calculate whether a business meets nexus varies from state to state. For instance, as highlighted on the graph below, Massachusetts and New York require that both (1) the amount of sale requirement, and (2) the number of transaction requirement, be met to be considered to have nexus to the state, whereas all other states consider a business to have nexus in their state if the seller meets either one of the requirements. Other important differences are noted below:

- Measurement Date: Many states consider nexus to be met if a business meets a requirement in either the current or previous calendar year. However some states, such as Alabama and Michigan, only consider the previous calendar year. And other states, such as Pennsylvania, Tennessee, Texas, Illinois, and Connecticut, use a variation of a rolling 12-month period.

- Total Sales Calculation: States are generally divided on how to calculate total sales. Some use gross revenue, which represents all sales across the board. Others exclude certain items from calculation, such as non-taxable sales, items held for resale, and items that are not considered “tangible personal property”, such as digital items.

Many small businesses will not reach these thresholds themselves. If they do not, then the seller has no obligation to collect and remit sales tax. However, these small business transactions in the aggregate represents a substantial amount of sales tax revenue that is being left on the table. So in order to collect sales tax on these sales, states have put these same nexus requirements on marketplace facilitators, who are companies like Amazon, Etsy, and Ebay, who are used to facilitate e-commerce transactions. Since these facilitators meet these nexus requirements, they are responsible for collecting and remitting sales tax to the government, regardless of whether the seller of the item meets the nexus requirements or not. This has the effect of taking the sales tax burden off of the seller and onto the marketplace facilitator. For example, if you open a shop on Etsy and make a sale, because Etsy meets the nexus requirements, they will charge the buyer sales tax and remit it to the government themselves.

Let’s say you decided you did not want to charge the buyer sales tax and wanted to pay it yourself. That would be possible without the facilitator in the picture. However, when using the e-commerce facilitators, many are not going to allow that because they have the legal obligation to collect and remit it themselves regardless of the seller’s wishes.

Do I get a federal deduction for paying sales tax?

Possibly. The deduction occurs on Schedule A as one of your possible itemized deductions. The way it works is: the federal government gives every taxpayer a standard deduction, which represent their initial income for the year that will not be taxed. This is standard across the board. However, if a taxpayer itemizes their deductions and it results in a higher figure than the standard deduction, they are allowed to take that higher itemized figure. In 2017, the standard deduction was significantly increased, meaning that 95% of taxpayers now take the standard deduction and roughly 5% itemize.

If the sales tax paid, added with other eligible itemized deductions, exceeds your standard deduction, then it will have an affect of lowering your tax obligation. It is important for a taxpayer to remember to consider sales tax in their itemized deductions. This is frequently overlooked by taxpayers and tax professionals alike, due to the infrequency of itemizing deductions and the layout of Schedule A. Sales tax is considered on line 5 in conjunction with state and local income taxes paid. The taxpayer is able to itemize on line 5 the higher of:

- Their state and local income taxes paid during the year, or

- Their general sales tax paid (usually estimated using the IRS tool)

Because very few taxpayers keep track of all sales tax paid during the year, the IRS allows taxpayers to estimate the amount of sales tax paid based on the state and local sales tax rate in their area. You can find the sales tax estimator at the link below:

https://www.irs.gov/credits-deductions/individuals/use-the-sales-tax-deduction-calculator

What are Sales Tax holidays?

These are specified period of time where the state or local government waives their sales tax requirement on specific types of purchases made during that specified period of time in order to encourage spending. One of the more popular holiday is the sales tax holiday, which allows parents to purchase needed school supplies weeks before school starts without paying any sales tax.

Do I need to file a Sales and Use tax return?

It depends on what type of business you have. Local businesses that meet the nexus requirements do have a filing obligation. If you have an online store, you probably use a marketplace facilitator, in which case you do not as long as the facilitator is collecting sales tax from the buyer. If you are not sure about your sales and use tax obligations, we are happy to help. We can help interpret the legalese that makes up many of the statutes and tax forms and help you get complete and accurate filings in all states. You can contact us here to get the process started.

You can find us at our home website at MageeTax.com

You can check out other blog articles at TacklingFinance.com