Banking rewards, such as cash-back offers, points, and miles, have become a common incentive offered by banks and credit card issuers to attract and retain customers. However, the tax implications surrounding these programs often leads to confusion. So let’s look at a handful of common programs and discuss the tax status surrounding each. The 5 most common types of reward programs are:

- Credit Card Spending Bonuses

- Credit Card Spending Rewards

- Frequent Flyer Miles

- Bank Account Sign-Up Bonuses

- Referral Bonuses

It’s important to point out that there is not a lot of official guidance on the proper tax treatment for some of these items. This is due both to the recent evolution of many of these income programs and the insignificance amounts they typically represent. The general consensus used by both the banks and tax professionals is this: if the reward arises from a spending transaction, then the amount is a non-taxable rebate. Conversely, if it does not arise from a spending transaction, it is taxable income.

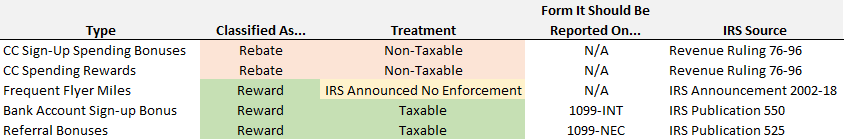

Let’s look at a chart highlighting the most popular types of rewards and how they are currently treated by most banks:

Frequent Flyer Miles

In 2002, the IRS issued Announcement 2002-18, which stated that the agency would not challenge any taxpayer over the accuracy of choosing not to include in their income the fair market value (FMV) of frequent flyer miles received during the year. This extends to similar programs such as frequent guest programs offered by hotels. While the IRS promised not to challenge it, it did not provide any positive or negative assurance one way or the other on the proper treatment, leaving the door open for it to potentially change in the future. Due to this relief, banks currently do not issue any form relating to the value of these miles or guest programs.

Bank Account Sign-Up Bonuses

In 2014, the Tax Court heard Shankar vs IRS, which centered around the taxability of reward points received relating to a bank account.[1] In tax year 2009, Mr. Shankar redeemed 50,000 “Thank You Points” that were attached to a bank account he had with Citi Bank, in order to purchase an airline ticket. Citi estimated the fair value of the airline ticket to be $668. Citi Bank issued Mr. Shankar a Form 1099-MISC for the amount, which he did not report on his return. The court found that the fair market value of the airline ticket was taxable income. However, it also stated that the income should be considered interest income and reported on a Form 1099-INT. It stated:

“We proceed on the assumption that we are dealing here with a premium for making a deposit into, or maintaining a balance in, a bank account. In other words, something given in exchange for the use (deposit) of Mr. Shankar’s money; i.e., something in the nature of interest.”

The opinion instructs that the income becomes earned by the taxpayer at the moment the points are “cashed in” and the amount is the fair market value of the item received at that same point in time. Currently, banks follow the same method, issuing a Form 1099-INT for the value of the item received when the points are cashed in.

It’s important to also note what the tax court opinion does NOT say. It highlights that it did not consider whether the points should be considered income at the moment they are “earned”, stating:

Neither party has addressed, nor do we consider, whether award of the thank you points, itself, may have been the taxable event.

This leaves the door open for a possible change in the future.

Credit Card Spending Bonuses & Credit Card Reward Points

In 1976, the IRS issued Revenue Ruling 76-96, which states that:

“A rebate received by a buyer from the party to whom the buyer directly or indirectly paid the purchase price for an item is an adjustment in purchase price, not an accession to wealth, and is not includible in the buyer’s gross income.”

This is used today as the rational for the non-taxability of credit card reward points and credit card spending bonuses. In both situations, the credit card company issues reward points only upon the cardholder making a transaction. Let’s provide an example of what each of these typically looks like:

- For Credit Card Spending Bonuses, the most common one is offered as an incentive to get an individual to sign up. They may advertise that a cardholder can receive a $200 bonus if they spend $1,000 in the first 90 days of having the credit card.

- For Credit Card Reward Points, many cards offer cash back on certain (or all) categories. This cash back is based on a percentage of the items price. For example, they may advertise that a cardholder will get 5% back on gas and groceries, and 1% back on everything else.

In both situations, at least 1 transaction has to occur in order to receive the reward. Therefore, it can be rationalized that the amount is a rebate being indirectly paid to the buyer. Currently, banks do not issue any tax forms for these credit card spending bonuses or reward points.

However, it’s important to highlight that many of these banks frequently design other unique reward programs that they believe will make them stand out above their competition. In these situations, whether the rewards are a rebate or taxable income is a grey area with no definitive guidance. For example, Discover has a “cash back match” program where, after the card has been open for one year, Discover will add up all the cash back the cardholder received during that first year, and match it. A Wall Street Journal article from 2019 quotes Discover’s spokesman who says that the company issues a Form 1099-NEC for the “cash back match” portion. Typically, if banks are unsure about the potential taxability, they will err on the side of caution and report the income to the IRS through the issuance of a Form 1099. However, receiving a Form 1099 does not mean the money is taxable. Whether you should report the income as taxable or not depends on the details surrounding the rewards program, the amount of money in question, and whether you desire to “play it safe” or not on your tax return. If a taxpayer believes that the Form 1099 should not have been issued and chooses not to report the income, they should file Form 8275 with the return explaining the situation.

This treatment was most recently upheld in Anikeev vs. IRS, which was litigated in 2021. In the case, Mr. Anikeev and his wife had two credit cards from American Express which provided 1-5% cash back on all purchases. They frequently went around to local stores and bought as many Visa gift cards as they could, earning them reward points in the process. After obtaining the reward points, they took the Visa gift cards and bought money orders, which allowed them to re-deposit the money back into their bank account. This activity spanned a two year period and netted them just over $300,000 in rewards before American Express closed their cards for violating the terms of service. This type of fake spending is frequently termed “manufactured spending” and is not allowed by the banks. It also caught the attention of the IRS, who investigated and determined that while they could not find any criminal charges to pursue, they believed the Anikeev’s should have paid income tax on these cash back rewards they received that were ultimately re-deposited back into their bank account. The Anikeev’s disagreed, and the case eventually ended up in Tax Court. The position of the IRS was that the Visa gift cards were cash equivalents rather than a good (a good is a general term for a purchased item). Since rebates can only occur on goods and services, this would prevent the gift cards from being classified as a non-taxable rebate. The Anikeev’s argued that it was a good and the income was a rebate of the purchase price. The tax court ruled in the Anikeev’s favor for the gift cards, stating that since the Visa gift card’s could not readily be deposited into a bank account, they could not be considered cash equivalents. However, the court did rule that any reward points from money orders or debit cards were cash equivalents, because these items can be readily deposited into a bank account.

While the Anikeev opinion ruled that the reward points from money order and debit cards are subject to taxation, it does not appear that banks are making any distinction. This could possibly be due to privacy concerns or a lack of information on the purchased item. Additionally, since these reward points for credit card transactions do not fit a common sense definition of interest, it would most likely be classified as non-employee compensation, which they are not required to report to the IRS unless the amount is $600 or more. For all of these reasons, the net result of the Anikeev case is affirmation of the continued treatment of transactional credit card reward points as non-taxable rebates.

Referral Bonuses

There is no specific guidance on referral bonuses for credit cards. However, since the rewards are for referring an individual and not for making a credit card transactions, these are treated as taxable income. It is treated similarly to commissions or kickbacks. IRS Publication 525 outlines that kickbacks should be reported either as “other income” on your Form 1040 (not subject to self-employment tax), or on Schedule C (subject to self-employment tax) if the referral bonuses make up a substantial part of your annual income.

If you need assistance with reporting your bank reward income, we are happy to help. You can get the process started by contacting us here.

You can find us at our home website at MageeTax.com

You can check out other blog articles at TacklingFinance.com